As your neighborhood home insurance agent based in Plymouth, MN, I have seen firsthand how the rising cost of homeowners insurance is impacting our community. It’s been all over local news. Axios Twin Cities just published an article “Rising auto, home insurance premiums stinging Minnesotans“, WCCO News did a story “Why is the cost of homeowners insurance going up in Minnesota?” and KARE 11 reported “Car insurance rates up 55% in Minnesota? New report says it’s the highest increase in the country“.

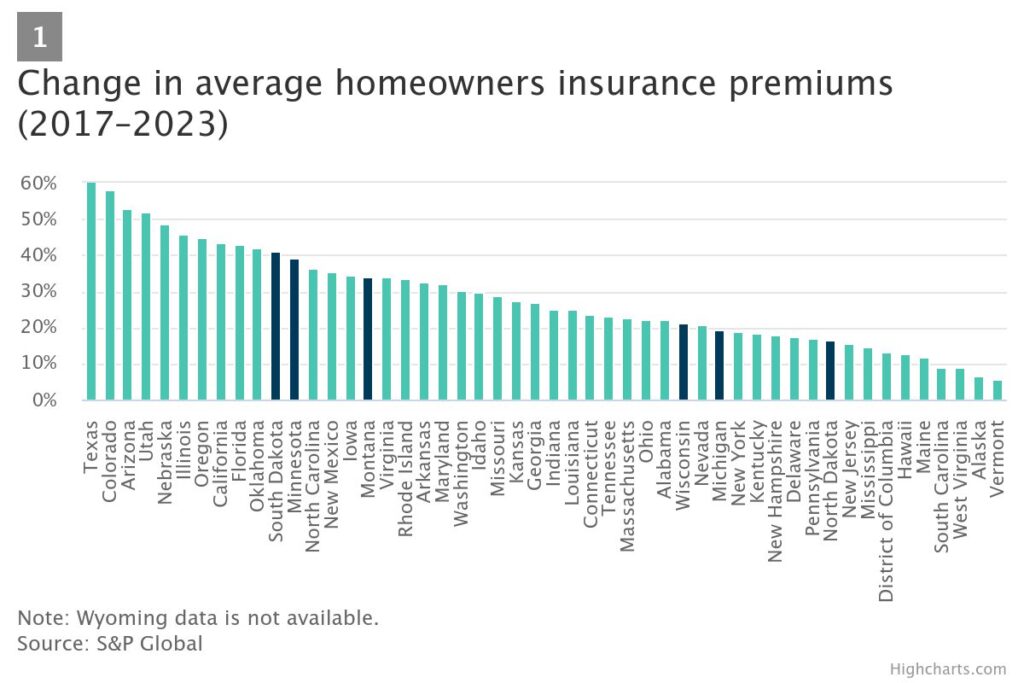

It’s no secret that premiums have skyrocketed, with an average increase of 39.1% from 2017 to 2023. This year alone, we’ve witnessed a staggering 15% jump. I understand the strain this puts on your budget, and I’m here to help.

Why the dramatic increase? It’s a perfect storm of factors. Catastrophic events like wind and hailstorms in our region, coupled with inflation in construction costs, have put immense financial pressure on insurance companies. For years, premiums haven’t kept pace with the payouts for damaged property. This isn’t just a Minnesota problem – it’s happening across the country.

But here’s the good news: as an independent insurance agent, I have access to multiple insurance providers. This means I can shop around for the best coverage at the most competitive rates. Whether it’s Nationwide, Progressive, Chubb, Safeco, or other reputable insurers, I can explore a wide range of options tailored to your specific needs.

While we can’t control Mother Nature or the broader economic forces at play, we can work together to find ways to potentially lower your premiums:

- Bundle policies: Combining your home and auto insurance can often lead to significant discounts.

- Increase your deductible: A higher deductible typically means lower premiums, but make sure it’s an amount you can comfortably afford.

- Improve home safety: Installing security systems or storm-resistant features might qualify you for discounts.

- Annual policy review: Let’s reassess your coverage regularly to ensure you’re not over-insured or paying for unnecessary add-ons.

Remember, homeowners insurance isn’t just about protecting your investment – it’s about peace of mind. For many of us with mortgages, it’s also a requirement. That’s why finding the right balance between comprehensive coverage and affordability is crucial.

As your local agent, I’m committed to helping you navigate these challenging times. I understand the unique needs of Minnesota homeowners, and I’m here to advocate on your behalf. Let’s work together to find a solution that protects your home without breaking the bank.

Don’t let rising premiums catch you off guard. Give me a call or stop by the office, and let’s review your policy. In these uncertain times, having a knowledgeable, local ally in your corner can make all the difference. Together, we’ll weather this storm and ensure your home remains protected for years to come.